For the first half of the week, all eyes were on the almighty CPI. Why, you ask? Well, Trump has been putting pressure on the Fed to cut rates and hasn’t held back in expressing his views on Fed Chair Powell in the media. This comes on the heels of newly announced tariffs on various countries last week, which put the market in a cautious mood. Investors were watching closely to see if inflation would dip, potentially paving the way for a rate cut.

What did we get?

CPI year-over-year came in at 2.7%—lower than expected but unchanged from the previous reading. Month-over-month CPI was in line with expectations at 0.2%, but lower than the previous figure. Core CPI YoY surprised to the upside at 3.1%, while MoM was steady and met expectations.

Stripping away the jargon: inflation data was broadly in line with market expectations. As a result, the market is now cautiously optimistic about a potential rate cut in September.

Meanwhile, Trump’s having a good week.

He’s gearing up for potential talks with Putin on Friday, making progress with China on tariff negotiations, and seeing an uptick in U.S. customs revenue—giving him bragging rights. He’s now claiming his tariffs aren’t inflationary and urging Powell to cut rates. Oh, and he also mentioned suing Powell over how he handled the Fed’s renovation—but that’s a story for another day.

Back to the markets—how are they reacting, and what’s next?

Optimism is building around a September rate cut. Treasuries are up, the dollar is down, and equities are climbing—classic signs of a risk-on environment. Looking ahead to Friday, retail sales data and the Trump-Putin conversation on Ukraine will be key. Keep an eye on oil.

My next moves

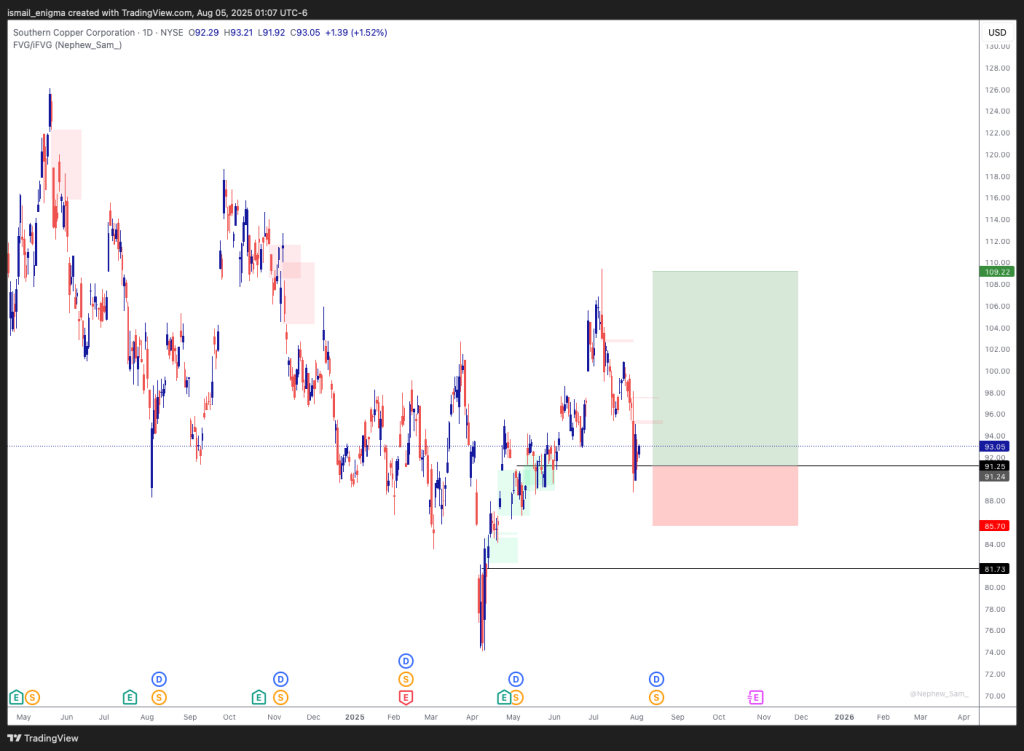

Like James Bond, I’m waiting patiently to catch the full risk-on wave. Markets are currently elevated—too rich for my blood. I’m cautiously long on palladium and watching closely for entry points in oil.

Palladium

Oil

Disclaimer: This is not financial advice. The content shared here reflects my personal opinions and observations on current market events. Please consult a licensed financial advisor before making any investment decisions

Subscribe for free and get access to more insight.