Welcome to August!

This month, I’m closely watching four stocks that I believe offer compelling opportunities. These are risk-on plays, all benefiting from what appears to be a faint light at the end of the tunnel in the ongoing tariff wars—though resolution still seems far off.

Here’s what I’m tracking:

- Tesla(TSLA): Tesla’s Q2 2025 earnings beat expectations. There’s growing excitement around its robotaxi innovation, and the market is gradually adjusting to the Trump-era tariffs. These developments make Tesla a stock worth watching this month .https://www.tradingview.com/x/SSmHsst8/

- Micron Technologies(MU): Micron has outperformed earnings for two consecutive quarters. While it shares the semiconductor space with giants like NVIDIA, it hasn’t been left behind. Analysts have upgraded it from “Hold” to “Buy,” and I’m considering tagging along for the ride.

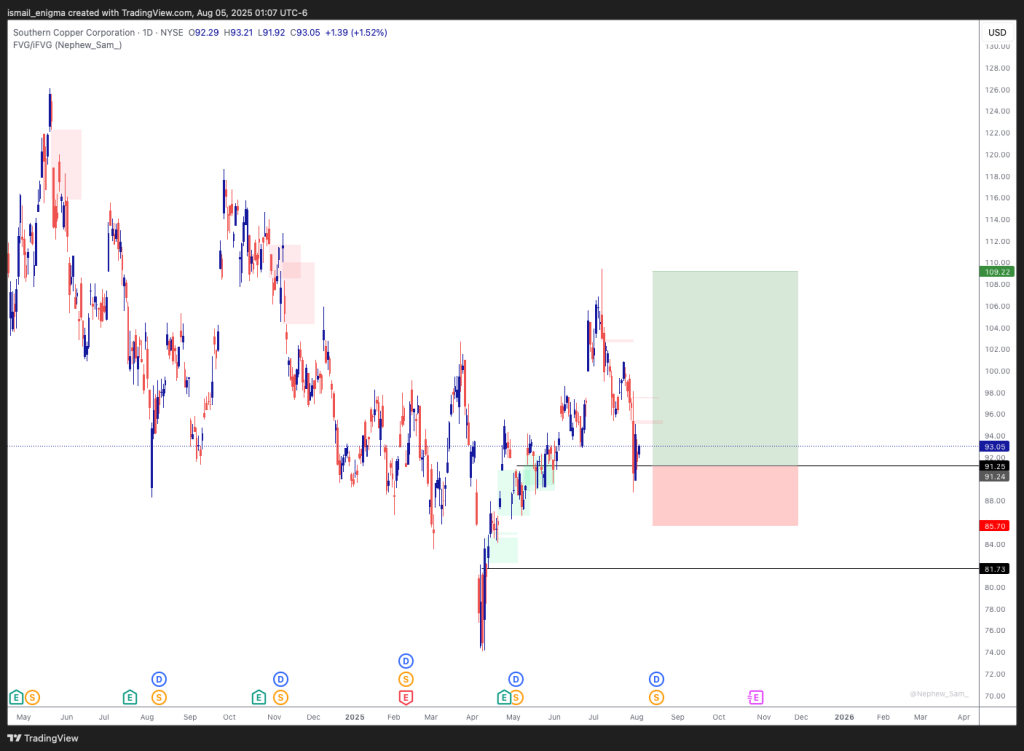

- Southern Copper Corporation (SCCO): SCCO, a major player in copper, silver, and zinc production, has posted strong earnings recently. It’s also benefiting from rising gold demand, which has shown a direct correlation. Technically, it’s at a favourable entry point.

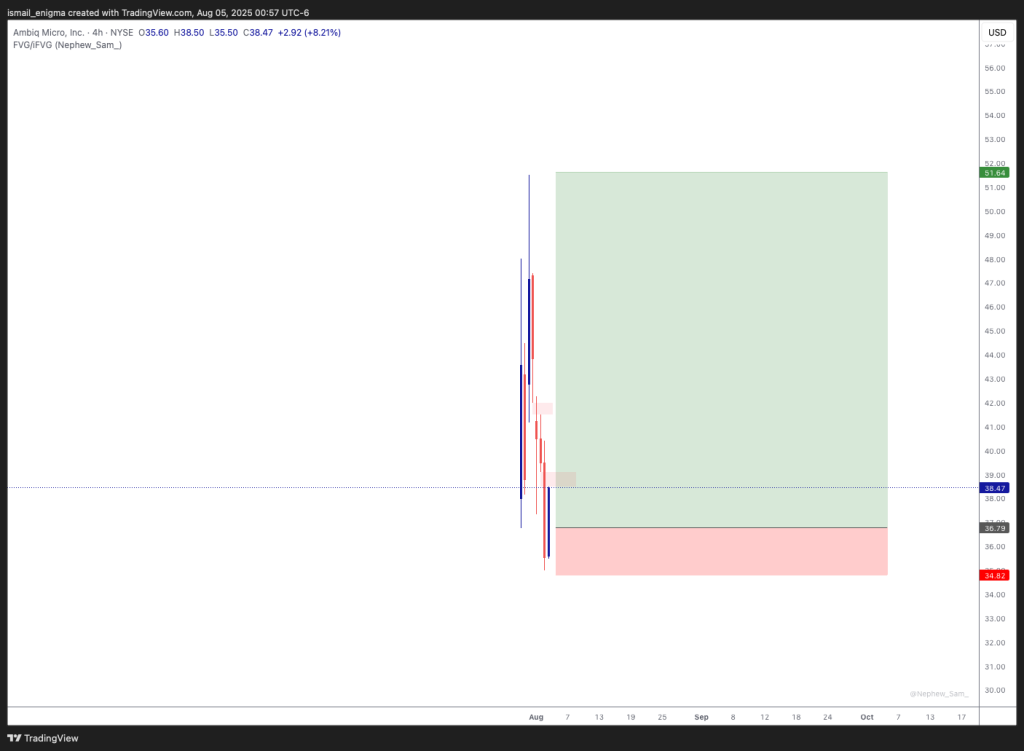

- Ambiq Micro.inc (Ambiq): A fresh IPO from last week, Ambiq is a semiconductor company focused on ultra-low-power solutions. With global interest—especially from China and other regions—this could be a promising growth stock.

That’s all for now.

I haven’t entered any positions yet, but I’ll be monitoring these names throughout the month. Expect an update at the end of August. BTW, all stocks as at this time are halal.

Disclaimer: This is not financial advice. The content shared here reflects my personal opinions and observations on current market events. Please consult a licensed financial advisor before making any investment decisions