Welcome to a new trading week and the start of September! Historically, September has been one of the weakest months for stocks and equities, so we might be starting with a slight disadvantage.

Last Week’s Market Recap

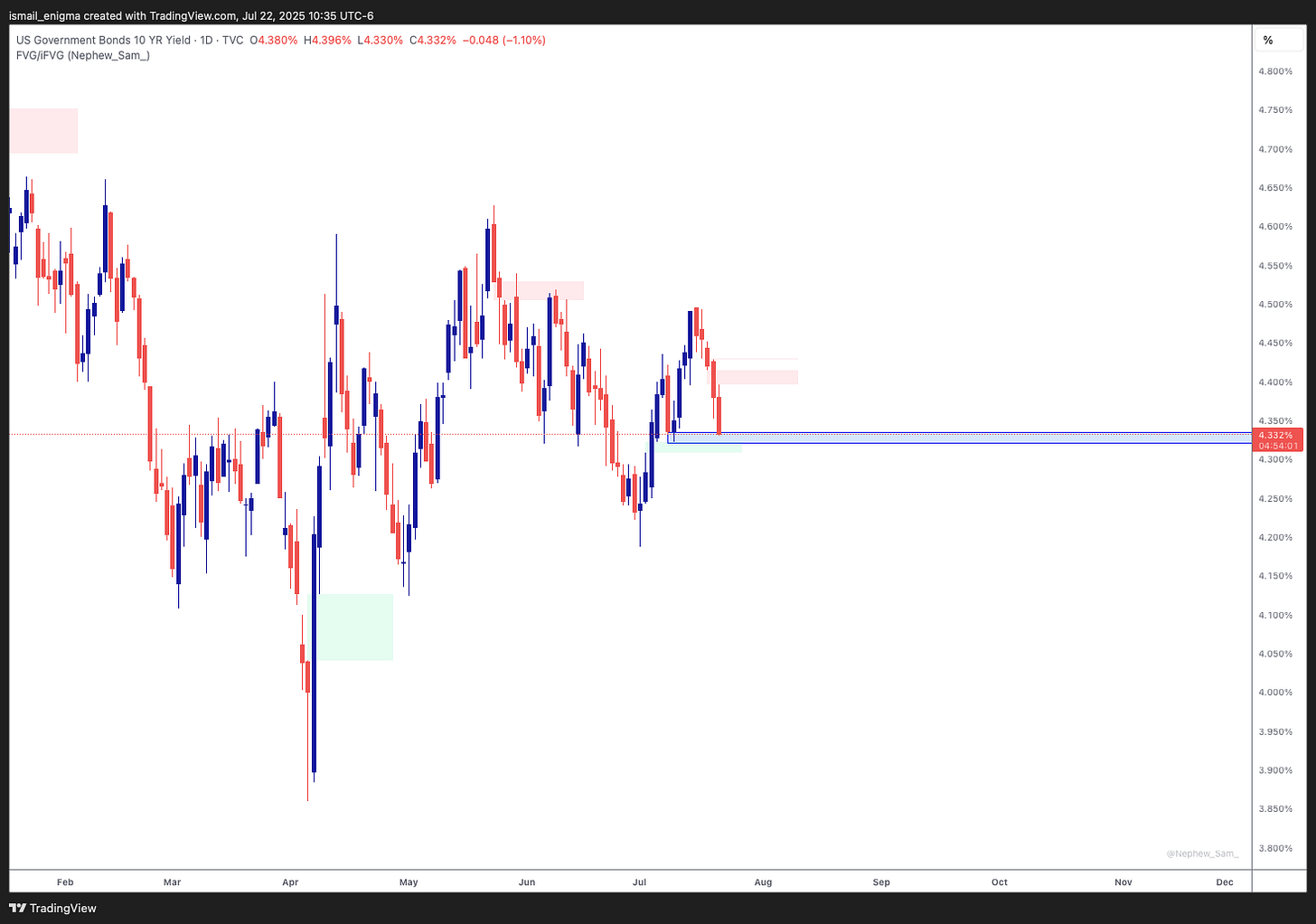

Last week ended on a negative note for equities. While we saw some upside earlier in the week, markets closed in the red. Meanwhile, safe-haven assets gained momentum and returned to all-time highs.

Key Events to Watch This Week

This week kicks off with the Labor Day holiday, but the main highlight will be Non-Farm Payroll (NFP) Friday, when the U.S. payroll report is released. All eyes will be on this data, and I expect the market to position itself ahead of Friday.

Other important economic events include:

- Tuesday: ISM Manufacturing PMI

- Wednesday: JOLTS Job Openings

- Thursday: Unemployment Claims and ISM Services PMI

Crypto and Market Outlook

On the crypto side, my XRP position is in drawdown, while ETH remains about 5% in profit. For equities, I expect some consolidation to start the month, with safe-haven assets likely continuing their upside. and we might get to tag along on Palladium while I monitor my risky asset position.

Also, remember this is an FOMC meeting month, so markets may consolidate until then. As always, we don’t predict the market—we react. Patience is key. Let’s see what September brings.

Disclaimer

This is not financial advice. The content shared here reflects my personal opinions and observations on market events. Trade Ideas shared are for educational purposes only. IOY Capital is not responsible for any investment decisions you choose to make.