It basically seems like Fridays are the days Trump decides to throw a wrench into the optimism he’s built up during the week—because seriously, what is bro talking about today?

Let’s take a step back and review what’s happened this week. Overall, it’s been relatively light, with markets primarily focused on:

📌 Tariff Talk: From Optimism to Uncertainty

Trump kicked off the week with upbeat comments like:

- “Biggest deal with Japan”

- “Deal with the EU is making progress”

But by Friday, the tone had shifted:

- “Deal with Canada? Not sure.”

- “EU deal is a 50-50.”

A very polarized individual, I must say. To add to the confusion, Japan responded by saying Trump exaggerated the details and that no written agreement exists. So, there’s that.

🏦 Powell and the Fed

Trump visited the Fed’s renovation project and made remarks about Jerome Powell. As predicted, he’s backtracked on firing Powell and will likely let him finish his term.

💼 Earnings Season Kickoff

Earnings season began this week with mixed results:

- Tesla fell short of projections.

- Alphabet Inc. (Google’s parent company) exceeded consensus expectations.

📈 Market Reaction

Despite the mixed signals, the market maintained a risk-on mood throughout the week, ending on a positive note:

- Gold fell ~3%

- SPUS (Sharia compliant SPX) rose 2.26%

- XLE gained ~2%

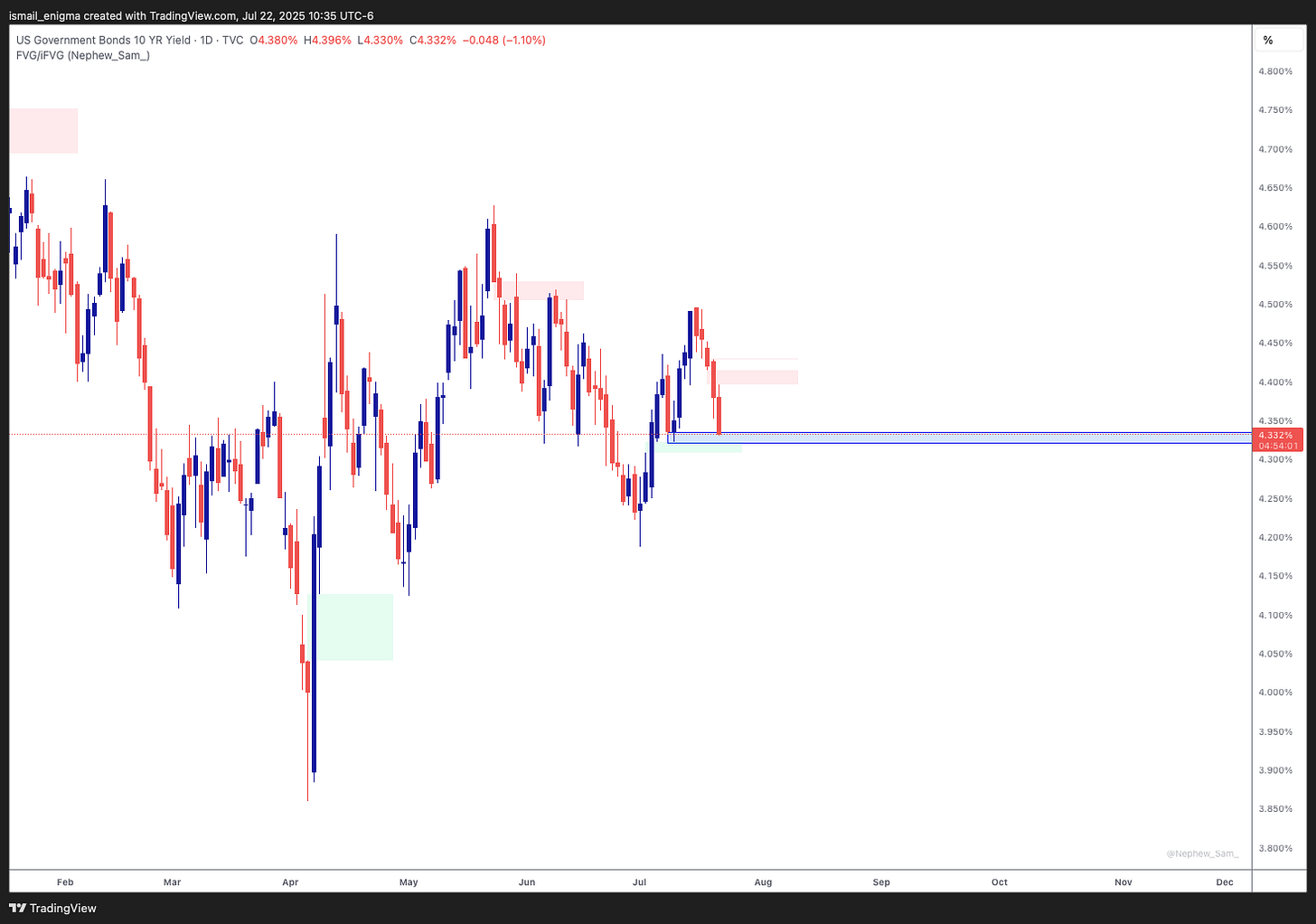

- DXY and US 10Y yields bounced from major support levels

My portfolio closed the week up 2%, thanks to the XLE trade.

🔭 Looking Ahead

Heading into the weekend, I’ll be watching for updates on the U.S.-EU trade talks and how markets respond in the new week.

🧘 Weekend Vibes

It’s the weekend—time to take a step back, relax with a glass of sparkling wine and some chicken, go for a run or a walk, and enjoy the break.

See you next week with our weekly outlook and trade ideas.

Cheers,

Olakunle Yusuf

Disclaimer: This is not financial advice. The content shared here reflects my personal opinions and observations on current market events. Please consult a licensed financial advisor before making any investment decisions.