We’re starting the week on a slow note—like a Monday morning in Lagos. But don’t be fooled, there’s still plenty happening beneath the surface. Let’s take a quick look back at last week, what’s on the radar this week, and how I’m positioning myself in the current market environment.

🔙 Last Week in Review

Last week, we got CPI data from both Canada and the U.S. The results? Nothing exciting. Month-over-month numbers were flat—like jollof rice without pepper. Basically, this confirmed that rate cuts are not coming anytime soon, maybe later in the year if the economy behaves.

Meanwhile, U.S. retail sales came in stronger than expected. Americans are still spending like they don’t have rent to pay. Good for the economy, bad for those hoping for quick rate cuts.

However, the real market focus wasn’t on the data—it was on Trump. Investors were glued to headlines about his proposed tariffs and his threat to fire Fed Chair Jerome Powell. That drama overshadowed everything else.

📅 What’s Ahead This Week

This week’s economic calendar is light, so attention remains on:

- Trump’s “I might fire Powell” drama

- Ongoing tariff negotiations

- Powell’s speech (which ended up being empty—no economic gist)

- The start of earnings season

So far, nothing major has happened. Trump now says he wants Powell out in eight months—basically when his term ends. So, no real firing, just political noise. Negotiations are still dragging, and Powell’s speech today? Zero economic content. We’re now waiting for earnings to bring some real movement.

🧠 Market Sentiment

The market is still in risk-off mode:

- Inflation concerns from Trump’s tariff threats are being priced in.

- Uncertainty around Powell’s future is keeping investors cautious.

- Overall, the market is starting the week on edge.

📊 Technical Picture

- Gold is testing the $3,400 level, approaching previous highs and resistance.

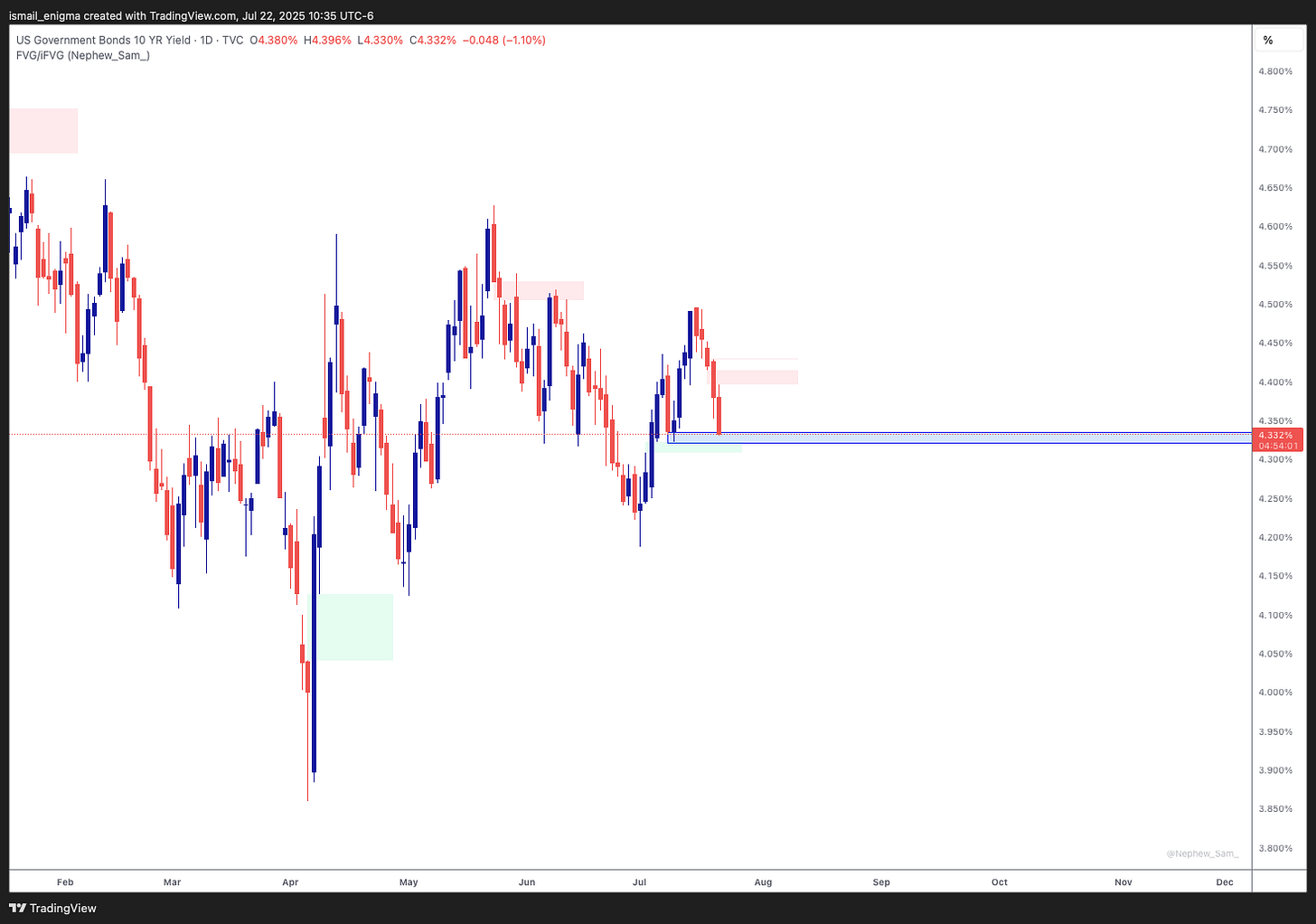

- U.S. 10-Year Yields are falling and testing support levels.

- Dollar Index (DXY) is also down, sitting at key support on the 4-hour chart.

🔮 My Outlook

🧩 Fundamentals

Trump seems to be softening his tone on Powell. While there’s still risk around unresolved negotiations with the EU, talks with China appear to be progressing, and Trump sounds optimistic. If that continues, we could see a shift in market sentiment—from “God abeg” to “maybe we go dey alright.”

📈 Technicals

We’re at support levels for both DXY and 10-year yields, while Gold is at resistance. If earnings come in strong, I expect risk assets to move higher.

💼 My Strategy

I’m looking at XLE and XSD for buy opportunities. Gold hasn’t given me a good entry point yet to tag along for the, so I’m staying patient and watching closely.

Thanks for reading! If you enjoyed this update, feel free to share it or subscribe for more weekly insights. Let’s keep making sense of the markets—one gist at a time.

Disclaimer: This is not financial advice. the content shared here reflects my personal opinions and observations on current market events. Please consult a licensed financial advisor before making any investment decisions.

Leave a Reply